How Can We Fix A Check On Quickbooks

Checks are written orders to a bank to pay the amount listed on the check to the person depositing the check. They're considered as good equally cash.

| In this article:

|

Write a check

Regular checks

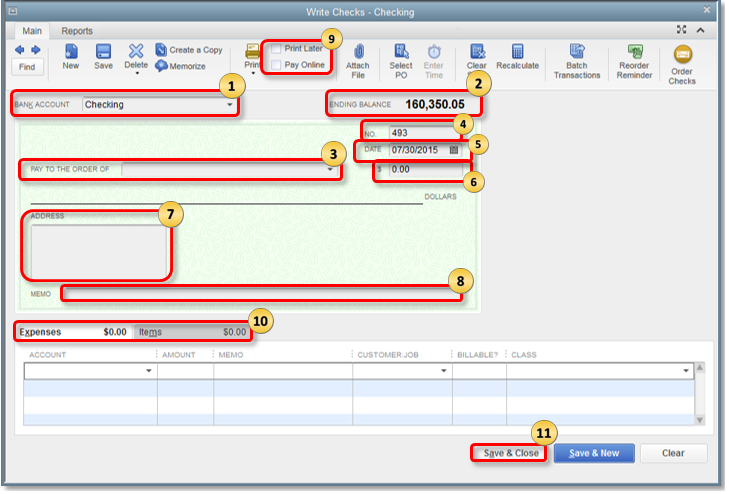

In QuickBooks Desktop, you use regular checks to pay for a stock-still asset, inventory and not-inventory role, service, other charges, and whatsoever expense you track. You can as well use this form to put coin into a petty cash account or pay credit card dues. To write checks, get to the Banking bill of fare and select Write Checks.

- Bank Business relationship: Account where the money will be taken from.

- Ending Balance: Balance of the given banking company account equally of the engagement of writing the checks.

- Pay to the Order of: Should be the Payee Proper name or whoever the bank check was issued for.

- No.: In QuickBooks, the number is assigned depending on the check number preference you set.

- Engagement: Employ the appointment when you result the cheque.

- Amount: Cheque amount in numbers. Below the Pay to the order field volition automatically prove the Dollar amount in words.

- Accost: The payee address is automatically populated from the payee name setup.

- Memo: This field can be left blank but mostly, it is used as an unofficial note for additional details like the account information, the period, and what the payment is for.

- Print Later or Pay Online: Put a checkmark in the Print Later checkbox if yous need to print the check at a later fourth dimension or the Pay Online checkbox if you will process an online payment.

- Expenses or Items tab

- Apply the Expense tab to enter shipping charges, liability (in cases of payments for liabilities/loans), and other expenses not associated with any particular in QuickBooks.

- Use the Item tab to choose the appropriate item on the drop-down list.

- Select Save & Shut.

Other Check forms

- Beak Payment Check: Generated when you select the Pay Bills option in QuickBooks Desktop.

- Sales Taxation Checks: Checks created to pay your sales tax liabilities.

- Paycheck: Checks issued to an employee in payment of salary or wages.

- Payroll Liability Checks: Checks created to pay or remit payroll taxes you withheld from employees or whatever your company owes as a result of your payroll. These include 401(k) contributions, Wellness Insurance contributions, Union dues, and Garnishment for child support.

Delete or void a check

Before yous start, be sure you understand the difference betwixt deleting and voiding a check.

| Voiding a cheque changes the amount of a check to $0.00. VOID is added to the Memo field. Yous can always re-enter a voided check. Do this if you want to keep a tape of the check in QuickBooks. Deleting a check removes the record of the transaction from QuickBooks. It'll exist like it never happened. You lot can't undo this, but you lot can re-enter a deleted check. |

Void a written check

- Select the Banking card, then selectUse Register.

- From the drop-downwardly, choose the account you used to write the check.

- In the Bank Register, select the check.

- Select the QuickBooks Edit bill of fare, then selectVoid Cheque.

- Select Record.

Void a blank check

- Create a check with the amount of $0.00.

- Enter a payee proper noun, and assign an business relationship in the Expenses section.

- Select the Edit menu then Void Check.

Delete a check

- Select the Banking menu, then select Utilise Annals.

- From the drop-down, choose the business relationship you used to write the check.

- In the Banking company Annals, select the bank check.

- Select the QuickBooks Edit menu, then selectDelete Check.

- Select Record.

Impress checks

- From the Write Checks window, select the Print icon then select:

- Bank check- To print a unmarried check. When you choose this option, you will exist prompted to enter a Printed Check Number.

- Batch - To print multiple checks you marked for Print Later. When you choose this option, yous will be redirected to theSelect Checks to Print window. Put a checkmark on the cheque/s you want to print then selectOK.

- On the Impress Checks window:

- Select the Printer name and Printer type.

- On the Check Style section, choose if you want to impress the check as Voucher, Standard, or Wallet.

- If your pre-printed checks already have your company proper name and address on it, uncheck the checkbox Print company name and address.

- Check and make sure all other settings are correct.

- Select Print.

You tin can get secure checks guaranteed to be compatible with QuickBooks at Intuit Market.

Currently, QuickBooks doesn't have the functionality to print Magnetic Ink Graphic symbol Resolution (MICR) fonts on checks. You lot can cheque Intuit Marketplace for a third party software package designed to impress MICR font.

Memorize a check

For detailed steps on memorizing checks, run into Create an automatic recurring payment (check) to a vendor .

Print the check register

- Select the Edit carte, then selectUse Register.

- From the driblet-down, cull the account and so selectOK.

- Select the Impress icon at the top of the register.

- Enter the date range y'all desire to print.

Note: If you desire to print the divide item, place a checkmark in the box Impress splits item. - Select OK, then selectImpress.

Create a user part to write checks without seeing confidential data

When setting upward users in a role to write checks, QuickBooks requires users to accept access to a banking concern account. If yous are using QuickBooks Desktop Enterprise and yous don't want a user to see sensitive or confidential transactions in the bank register such as payroll, create a banking concern sub-business relationship. This gives you the ability to limit which of your depository financial institution accounts a given user can write checks from or view.

-

- Create a sub-account of the master checking account.

- Get to theLists menu, and then selectChart of Accounts.

- In the Chart of Accounts window, correct-click anywhere and select New.

- For the Account type, select Bank and then Continue.

- In the Business relationship Name field, enter A/P Cheque Register or anything that distinguishes it from other bank accounts.

- Put a checkmark in the Sub account of box and so select the business relationship where funds volition be drawn in transactions.

- Select Relieve & Close.

- Create a user role.

-

- Sign in as the QuickBooks Admin.

- Select the Company menu, and so select Users thenPrepare upwards Users and Roles.

- Select the Office List tab.

- Create a new role, or duplicate ane similar to the access needed for the user.

- Modify the role:

- Select the + in front of Banking.

- Let Full access to Create Checks.

- While still in the Cyberbanking surface area, select the + sign in front of Bank Registers.

- Select +next to the main checking business relationship.

- Highlight the newly created sub-account, and let View and Print access.

- Keep to modify the role for access to other duties as needed.

-

- Create a sub-account of the master checking account.

This method could be reversed to keep payroll or other confidential transactions in a sub-account accessible only to users who need access to the information. Specified users could be given access to the master account for various register activities and non exist able to see the confidential transactions from the sub-account.

Mutual problems and unexpected results

Check number is ever the same

When you lot write a check, the check number is ever the same even after saving a bank check with a unlike number. The adjacent check number is stored in the Check Number Queue therefore, the queue is damaged and must be repaired. Endeavor the following solutions to gear up the issue:

- Resolve information damage on your company file .

- Write a bank check again. If the number is notwithstanding incorrect, save the check with the correct number.

Form field missing from the check register or Write Checks Window

When you open the bank check register or Write Checks window, the option to include class information is missing. Checks and Deposits don't have source classes. You tin can add target classes by using the Splits button at the bottom left of the check register window.

If you lot open the register and the Grade field, Restore, or Record buttons are missing, close out of the window and reopen while holding the Shift key. If this fails to resolve the issue, please check your font DPI settings and screen resolution to ensure they are optimized to brandish QuickBooks properly.

- Make certain class tracking is enabled.

- From theEdit carte, selectPreferences.

- SelectAccounting preference.

- Select the Company Preferences tab.

- Select the Utilize class tracking checkbox.

- SelectOK to close the Preferences.

- Open up the Register, and select the Splits button in the bottom left corner.

- This will add the option to add a Class.

- If you're not using the recommended Windows default font:

- In Windows, switch the display settings toSmaller - 100% (default).

- In QuickBooks, go to Cyberbanking, thenWrite Checks (and/or Vendors, then Enter Bills).

- In a bare transaction, under the Items and Expenses tabs, adjust the columns to be very narrow.

- Select Salve & Close.

- In Windows, switch the display settings back to Medium - 125%.

- In QuickBooks, readjust the cheque and nib entry grade columns as needed.

How Can We Fix A Check On Quickbooks,

Source: https://quickbooks.intuit.com/learn-support/en-us/help-article/write-checks/create-modify-print-checks/L6KKhHjlA_US_en_US

Posted by: stewartafre1969.blogspot.com

0 Response to "How Can We Fix A Check On Quickbooks"

Post a Comment